A Biased View of Clark Wealth Partners

Wiki Article

The Best Strategy To Use For Clark Wealth Partners

Table of ContentsNot known Facts About Clark Wealth PartnersAbout Clark Wealth PartnersThe 5-Minute Rule for Clark Wealth PartnersAn Unbiased View of Clark Wealth PartnersSome Known Facts About Clark Wealth Partners.

Their role is to aid you make informed choices, prevent pricey blunders, and remain on track to fulfill your long-lasting objectives. Managing funds can be complicated, and feelings typically shadow judgment when it pertains to money. Concern and greed, for instance, can lead to spontaneous choices, like panic-selling throughout a market downturn or chasing after choices that do not line up with your threat resistance.

It's important to understand their fee structure and ensure it fits your financial scenario. For numerous individuals, the experience, neutrality, and comfort that a consultant offers can be useful, but it is essential to take into consideration the associated expenses. Equally as athletes, fitness instructors, and trainers aid people accomplish their finest in various other locations of life, an economic advisor can play a vital duty in helping you develop and safeguard your monetary future.

Financiers must make financial investment choices based upon their distinct financial investment purposes and financial circumstance (https://www.anibookmark.com/user/clarkwealthpt.html). ID: 00160363

Clark Wealth Partners - Truths

So it's regarding aiding clients to navigate modifications in the environment and understand the impact of those modifications on a recurring basis," states Liston - Clark Wealth Partners. A consultant can additionally help clients handle their properties better, claims Ryan Nobbs, a financial consultant for M&G Wide range Suggestions. "Whereas a client could have been saving formerly, they're now going to begin to draw an earnings from different properties, so it's regarding placing them in the ideal items whether it's a pension, an ISA, a bond and after that attracting the revenue at the ideal time and, critically, maintaining it within specific allocations," he claims"Then you get right into the world of tax obligation returns, estate planning, gifting and wills. It's quite hard to do all of that on your own, which is why an expert can aid clients to cut through the intricacy." Retirement planning is not a one-off event, either. With the appeal of revenue drawdown, "financial investment doesn't quit at retired life, so you need an element of competence to know just how to get the appropriate mix and the ideal equilibrium in your financial investment remedies," claims Liston - https://medium.com/@clarkwealth62269/clark-wealth-partners-fb06c088f587.

Some Known Details About Clark Wealth Partners

As an example, Nobbs had the ability to help one of his customers relocate money into a variety of tax-efficient products to ensure that she can draw a revenue and wouldn't need to pay any type of tax obligation up until she had to do with 88. "They live pleasantly currently and her husband had the ability to take very early retirement therefore," he claims."People can come to be truly worried concerning just how they will certainly fund their retirement since they don't know what setting they'll be in, so it pays to have a discussion with a monetary adviser," states Nobbs. While saving is one apparent advantage, the worth of suggestions runs much deeper. "It's all concerning offering individuals comfort, comprehending their demands and assisting them live the way of life and the retired life they want and to care for their household if anything should occur," states Liston.

Looking for monetary suggestions might seem frustrating. In the UK, that is fuelling an expanding guidance void only 11% of adults surveyed stated they would certainly paid for economic suggestions in the previous 2 years, according to Lang Cat study.

This is known as a restricted recommendations service. With changes in tax legislation and pension policy, and with any luck a long retirement in advance, individuals approaching the end of their jobs need to navigate a significantly challenging background to guarantee their financial needs will be met when they retire.

Things about Clark Wealth Partners

"If you get it incorrect, you can wind up in a series of challenging circumstances where you might not be able to do the important things you want to carry out in retirement," claims Ross Liston, Chief Executive Officer of M&G Wide Range Suggestions. Seeking monetary advice is a great idea, as it can assist people to appreciate a trouble-free retirement.

While there's a wealth of financial planning info readily available, it's significantly challenging to move on with a determined method that does not overreact or remain asleep at the wheel. A monetary strategy customized to your particular circumstance produces purposeful value and satisfaction. And while it might be alluring to self-manage or make use of a robo-advisor to minimize professional fees, this method can prove expensive in the future.

Right here are the leading 5 reasons that hiring an expert for economic guidance is useful. While it might be tempting to self-manage or make use of a robo-advisor to minimize specialist costs, this strategy can show pricey in the future. An economic consultant who supplies an independent and objective perspective is vital.

Some Known Questions About Clark Wealth Partners.

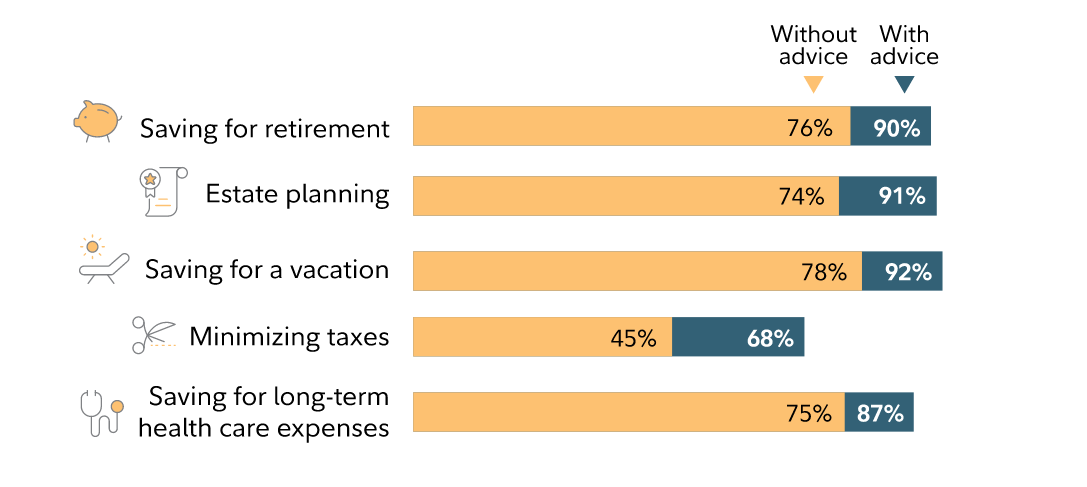

By comparison, investors that are functioning have a tendency to value retirement and tax preparation guidance best. These findings might show some generational result, considering that economic recommendations traditionally has been more concentrated on financial investments than economic planning (financial planner scott afb il). The intricacy of one's situations likewise may have an impact on the perception of valueAll informed, individuals that pay for advice ranked extra advice aspects as very valuable than those that did not. This outcome might suggest that searching for worth in more elements causes people to spend for guidance. The reverse can be true in some instances: Paying for an expert may strengthen the idea that the benefits are useful.

Since the economic situation modifications and evolves everyday, having a rational good friend at hand can be a crucial element for effective investment choices. Every individual has his or her own monetary situation and challenges to take care of (https://piratedirectory.org/Clark-Wealth-Partners_231760.html). A monetary organizer meticulously checks your present possessions and liabilities, and future objectives to create an individualised personal financial strategy

Report this wiki page